Investing used to be complicated and only for wealthy individuals. Financial markets were almost not accessible to the general public. Fortunately, that has changed. Investing has become available for (almost) everyone.

Nowadays there is no minimum amount you need to start investing. You can start with as little as $1. However, you do need an investment account.

You don’t need money to open an investment account

As said, to invest you’ll need to open an investment account with a broker. That account is needed to have access to the markets. The good news is, opening an account is free with many providers. Just remember that while opening an account may be free, investing itself isn’t. There are almost always fees involved.

Investing does come with some fees

Unfortunately, it can be tricky to find out exactly what investment fees are and how much they cost. It’s often the case that you have to look into what you’re actually paying for your investments.

It’s important to note that these can vary depending on the investment platform, type of investments, and your specific situation. Here’s a breakdown of common investment costs and fees:

Brokerage Fees

- Commission fees: some brokers charge a fee for buying or selling stocks, ETFs, or other securities. Luckily, many brokers now offer commission-free trading for stocks and ETFs.

- Account maintenance fees: some brokers charge a regular (monthly or annual) fee for maintaining your account. Many don’t!

Investment Product Fees

- Expense ratio: for mutual funds and ETFs, this is an annual fee expressed as a percentage of your investment. Many low-cost index funds have expense ratios below 0.1%.

- Load fees: some mutual funds charge a sales fee (load) when you buy or sell shares.

Advisory Fees

- If you use a financial advisor or robo-advisor, you may pay a fee for their services. Often a percentage of your assets under management.

Foreign Investment Fees

- Additional fees may apply when investing in foreign markets or currencies.

Administrative Fees

- Fees for services like paper statements, wire transfers, or expedited check delivery.

find the most cost-effective solution

Before you start investing, it’s important to really understand the costs involved. Every broker has different fees, and these can sometimes be surprising. Also good to know, even small differences in fees can have a significant impact on your investment returns over time.

It’s always a good idea to carefully review the fee structure of any investment or platform you’re considering and compare options to find the most cost-effective solution for your investment strategy.

Some small tips to keep your costs as low as possible:

- Use low-cost index funds or ETFs

- Choose a broker with low or no commission fees

- Avoid frequent trading to reduce transaction costs

- Be aware of all fees associated with your investments and account

So, I can start investing with only $50?

Yes, you can! And please don’t underestimate how powerful investing can be in the long run. Some people never start, especially if they have a small budget. They think investing isn’t possible with limited funds. To help you get over this hurdle, try doing a simple calculation to see what investing could mean for you, even if your budget is small. Follow me through the steps below and see how even a little bit of money each month can build a small fortune.

Step 1: Decide how much you want to invest every month

First you need to decide how much you’ll invest every month. Let’s assume $50. And yeah, you can start investing with only $50! This can be a great way, even with a smaller budget, to build that small fortune.

Important: Only invest money you can afford to leave alone for some time. Why? You’ll see in step 2.

Step 2: Decide how long you want to invest

How to decide on how long you want to invest? Sounds difficult, but actually it is not. Your investment time frame depends on your goal. When do you need the invested money?

“In my investing career, the best gains usually have come in the third or fourth year, not in the third or fourth week or the third or fourth month.”

You may not have a specific goal, yet. In that case a helpful rule of thumb for investing time frames is to only invest money you can leave untouched for at least five years. This five-year period helps reduce the impact of short-term market ups and downs. It gives your investment enough time to hopefully grow.

If you’re investing for long-term goals like retirement, you might consider a 20- to 40-year horizon. The longer the time frame, the more you benefit from compound interest. Which is the growth on your initial investment plus any returns it generates over time.

The power of compound interest really shines with a longer time horizon, letting even smaller contributions grow into that small fortune.

To find out how big that small fortune could be, let’s move on to step 3.

Step 3: Use a realistic expected rate of return

Again, this sounds complicated. How are you supposed to know what a realistic expected rate of return is? To come up with a number that could make sense, let’s look at the data we know. Past performance.

Although that doesn’t guarantee future results, the S&P 500 has historically delivered an average annual return of about 10% before inflation, or around 7% after adjusting for inflation.

This average includes dividends and covers a wide range of market conditions over the last century. So, let’s use 7% as the expected rate of return.

Important: keep in mind that returns vary widely year-to-year, so investing with a long-term outlook remains crucial.

Step 4: Calculate your small fortune

Once you’ve completed the first three steps, you’re ready to calculate the small fortune you can build. You’ll see how even with no starting capital, just a small monthly investment, you can build wealth over time.

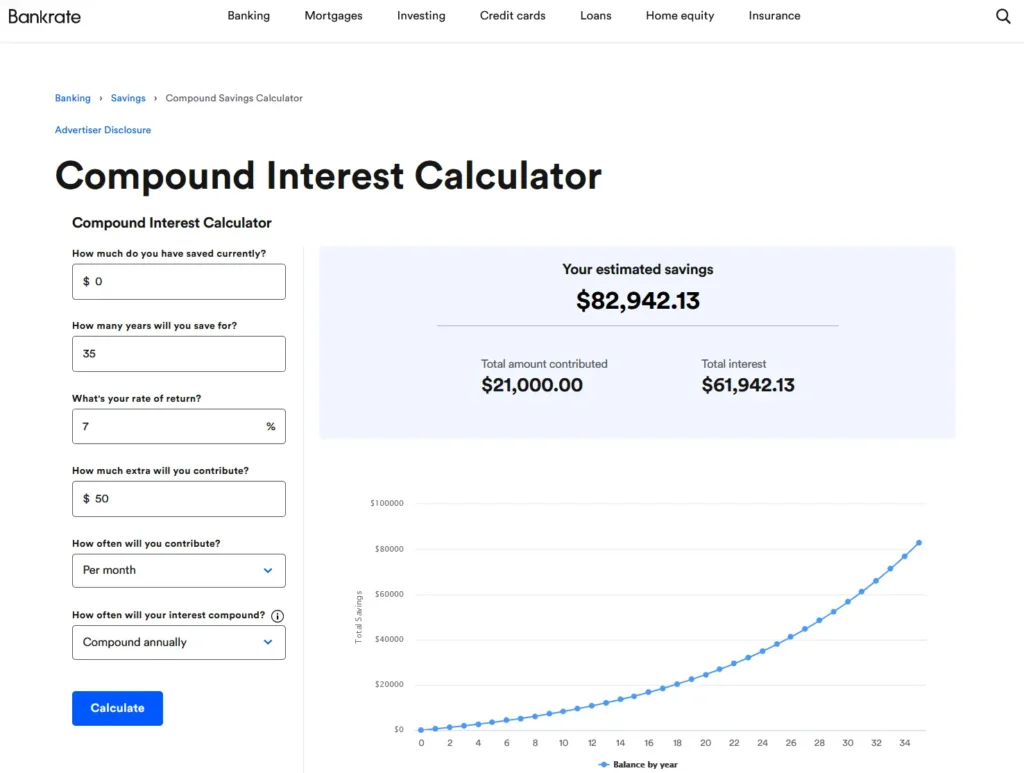

To calculate the fortune you could use this tool of bankrate.com: Compound Interest Calculator

Let’s give it a try, just as an example. To see how it works. I will follow the steps to get the needed data.

In step 1 I assumed you’ll invest $50 every month. In step 2 we need to decide on a time frame and a goal. For now, let’s use 35 years as a retirement goal. In step 3 the expected rate of return needs to be set. Let’s just go with the 7% average as explained.

Now we use this data to fill in the mentioned Bankrate tool. If you do, it looks something like this:

As you can see, your $50 monthly will grow to over $80.000. A small fortune indeed. Now would be a great time to play around with the tool, change the monthly amount or the rate of return or the time frame. See where it takes you.

So, how much do you need to start investing? Not that much, but even that can build a small fortune.

Extra tips for starting small

Here are some extra tips for investing with a small amount of money:

- Don’t try to time the market. It is impossible to predict when the stock market will go up or down. The best strategy is to invest for the long term and not try to time the market.

- Invest in index funds. Index funds are a type of mutual fund that tracks a specific market index, such as the S&P 500. Index funds are a great way to diversify your investments and reduce your risk.

- Rebalance your portfolio regularly. As your investments grow, you will need to rebalance your portfolio to make sure that your asset allocation is still in line with your risk tolerance.

- Have investment goals. The amount you should invest depends on your specific goals and when you need to reach them.

- Use micro-investing apps. These enable you to invest small amounts of money. For example, your spare change. This makes it very easy to start investing.

- Look for brokers offering fractional shares. These let you buy portions of stocks with small amounts of money.

- Consider low-cost index funds or ETFs. They provide diversification even with smaller investments.

- Use a gradual approach. Start with what you can afford, even if it’s a small amount, and consistently invest over time.

Remember, the key to successful investing is not necessarily how much you start with, but rather consistency, proper strategy, and increasing your investments over time as your financial situation allows.

What does a stock or ETF cost?

We now know the minimum amount you need to start investing. And a broker might be free, but you still have to pay for the stock or ETF. The price of a single stock can range from a few cents to a few thousand dollars. Just take a look at Berkshire Hathaway. Current stock price over $600.000. Fortunately, that is just one stock, it certainly doesn’t mean you can’t get involved in the stock market.

Thanks to ETFs, anyone can invest in the stock market in a cost-effective and well-diversified way. Here are some examples of ETFs that will not break the bank and add to a well-diversified portfolio.

The Vanguard Total Stock Market ETF (VTI)

This ETF seeks to track the performance of a benchmark index measuring the investment return of the overall stock market, the CRSP US Total Market Index. It’s passively managed and provides broad exposure to the entire U.S. stock market, including large-, mid-, and small-cap stocks. The expense ratio is only 0.03%. Very low! Since its inception (05/24/2001), this ETF has had an average annual return of almost 9% (8.80%).

iShares Core MSCI World UCITS ETF (IWDA)

This ETF seeks to track the performance of the world, the MSCI World Index, which includes a large variety of the 1,400 biggest companies worldwide in more than 20 developed markets. Since it was launched on September 25, 2009, this ETF has had an average annual return of about 8%.

The fact is that with this ETF, you benefit from economic growth in different regions without being too dependent on a specific market or sector. While this ETF might have less growth potential compared to a sector-specific ETF, it offers a good balance between risk and return. In other words, the risk is limited, but so is the return.

SPDR MSCI World Technology UCITS ETF (WTCH)

If you do want a sector-specific ETF, you could go with the SPDR MSCI World Technology ETF, which tracks the MSCI World Information & Technology index. Dividends are automatically reinvested, and with an expense ratio of 0.30% per year, this is the cheapest Tech ETF that tracks the mentioned index.

The low costs are important for this ETF because technology stocks already carry a higher level of risk due to their strong dependence on innovation and fast growth. With this ETF, you can take advantage of that growth. Since the risk is relatively higher, we want to keep the costs low. With this ETF, you’ll be invested in companies like Apple, Microsoft, Nvidia, Broadcom, and ASML.

iShares STOXX Global Select Dividend 100 (ISPA)

With this ETF we are looking at investing in dividends. Particularly popular when interest rates are low. During those periods, saving is often less attractive, and dividends become a welcome alternative for fixed income. Furthermore, dividend stocks often indicate stability and healthy finances. Companies that regularly pay out profits show that they have a healthy cash flow and deliver solid performances. Since its inception, 09/25/2009, this ETF has had an average annual return of almost 9% (8.93%). The expense ratio is a bit higher, 0.46%.

Investing in dividends is not always as exciting, but it is more reliable. These types of stocks are often chosen by investors who are not necessarily looking for the fastest profits, but rather value consistency and stability. The ETF follows the STOXX Global Select Dividend 100 Index and includes stocks such as AT&T, Shell, China Mobile, and Banco Santander.

Final thoughts

Investing is easier than you might think, and you can definitely begin with a small sum of money. By setting up an account and being mindful of the fees, you can begin your investment journey. Even modest amounts can grow into that small fortune.

Hopefully, you now believe that starting investing with a small amount is something you can really do.

But how do you begin investing? Well, there are some steps you need to follow, and if you want to do it right, there are different factors you need to consider. I wrote about this in a previous article.

Leave a Reply