0

a never-ending list of financial things

how to reshape your approach to money

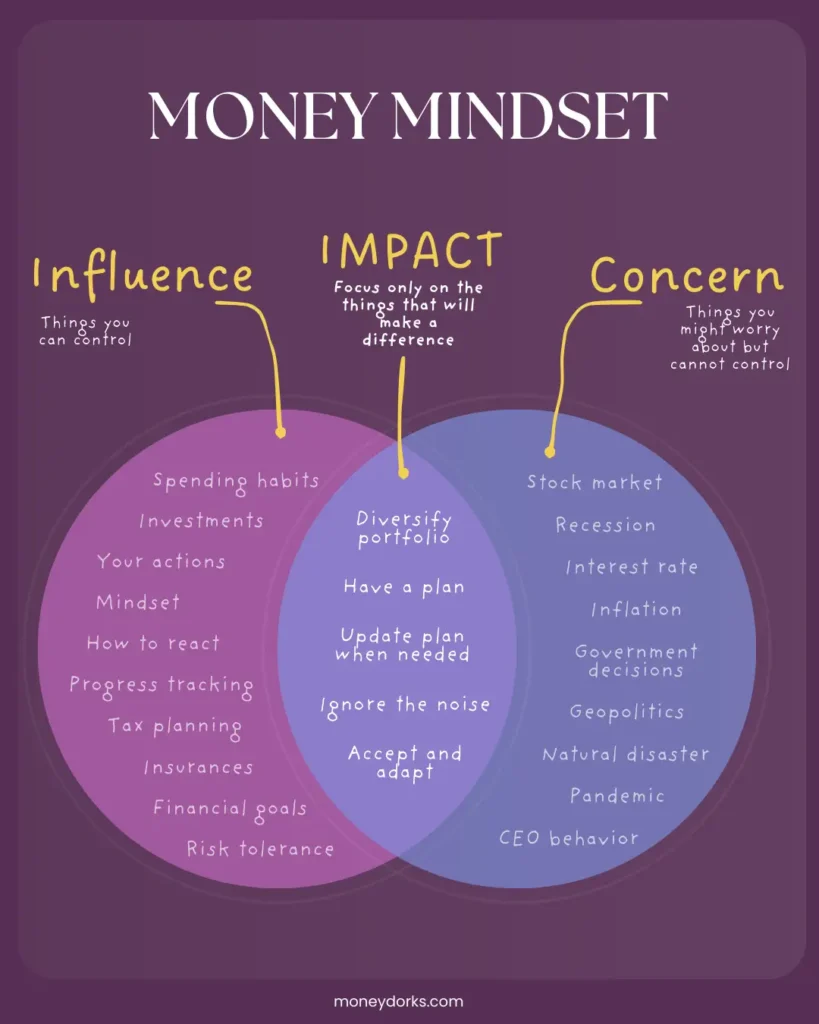

Money, an important topic for all you Moneydorks reading this 🤑, and it’s something we all have to deal with. Like paying bills, taxes, saving, investing, budgeting. It can feel like there’s a never-ending list of financial things to worry about. And while that may be true, should you be worrying about it all?

I don’t think so. And why is that? Because a lot of your money worries are based on things you have no control over. Why worry about something you can’t control? It’s completely useless and a waste of your energy.

What if you focused only on what you can control? You could see real financial improvement by simply changing your mindset and actions.

The key is to focus on the overlap between what you worry about and what you can control. In other words, focus your energy on the aspects of money management that you can actually control.

In this article, I will explore the highlights of how this principle can reshape your approach to money.

1

Almost everyone experiences financial anxiety

You worry about a lot of things

I know you worry. We all do. If you’re like most of us, you worry about your money situation too. Money worries are relentless, right?

• What if the stock market crashes tomorrow?

• What if inflation wipes out my savings?

• What if I don’t save enough for retirement?

• What if I make the wrong investment and regret it for years?

These thoughts can keep you up at night and make it hard to relax. Just remember, you’re not the only one. Financial anxiety is something almost everyone experiences at some point.

You probably know what I’m talking about, right?

2

your sphere of influence is not that big

You can only influence a tiny part of all those things

If you know what I’m talking about, you probably know that most of your financial anxiety comes from things you can’t control. Things like global economic trends, the stock market, geopolitics, interest rates, inflation, or the next tech bubble.

It’s not healthy to try to control every little detail of your financial future based on what might happen. It’s exhausting and it doesn’t help. These anxieties are not worth your time.

You may be aware of this😉 but your sphere of influence is much smaller than your sphere of worry. There are many things you simply cannot control. But there are things that you can influence. Things like your actions, your choices, your thoughts, and how you react to what happens.

Your sphere of influence includes things like:

• Setting a realistic budget and sticking to it.

• Diversifying your investments to reduce risk.

• Regularly contributing to your savings and retirement accounts.

• Stay at your current job or not

• How you use your credit card

• Buy or rent your home

3

peace of mind comes from preparing for the future

Focus on the overlap

The magic happens where the two overlap. Where your influence can solve your problems. That overlap is your financial sweet spot. It’s the place where your actions can have real impact. By channeling your energy into this zone, you reduce stress and make meaningful progress toward your goals.

For example:

• Instead of worrying about market volatility, focus on maintaining a diversified portfolio.

• Instead of stressing over inflation, ensure your investments are designed to outpace it over time.

• Instead of obsessing over picking the next “hot stock,” stick to a solid, long-term investment strategy.

• Focus on being proactive, like saving for an emergency fund, or tracking your expenses.

Imagine how great it would feel to let go of all the what-ifs and focus on what you can control. Focus on what really matters: your financial goals, spending habits, and long-term plans. That way, you’re working to improve your finances, not dealing with uncertainties you can’t control anyway. You’ll set yourself up for success no matter what life throws your way.

Please remember that peace of mind doesn’t come from predicting the future. It comes from knowing that you’re prepared for it.

4

The overlap is where the magic happens

Last remarks

Financial happiness is not about avoiding risk or removing uncertainty. It’s about spending your money sensibly and focusing on what you can control. By focusing your attention on this intersection of what is important to you and what you can affect, you eliminate unneeded stress and position yourself for long-term success.

So, the next time you feel like your money issues are out of control, ask yourself two questions:

1. Does this align with my financial goals?

2. Am I able to influence this?

If the answer to both is yes, then take action. If not, let it go. Your time is better spent building a great financial foundation.

The overlap is where the magic happens.

Leave a Reply