Getting started with investing is simple

Don’t be intimidated by the world of investing! It might seem challenging and difficult at first, but you can absolutely do it as well. Have you ever felt like a dork that’s missing out? You’re not alone. There are simple ways to get started, you’ll be surprised.

How to start investing has been explained a lot. There are endless resources out there for you to use. Books, blogs, YouTube, and of course Google. A simple search will give you all the answers in no time.

But if you’re feeling stuck and unsure where to begin, don’t worry, I’ve got you covered. Here’s a list of the best articles that break it all down for you, in simple, understandable pieces:

- Wealthsimple: Investing Basics — A beginner-friendly guide with all the essentials.

- Fidelity: How to Start Investing — A reputable source that walks you through your first steps.

- Nerdwallet: How to Start Investing — Another easy guide full of practical tips.

- Investopedia: Investing $1,000 — Perfect if you’re working with smaller amounts but still want to make an impact.

- Fortune: How to Start Investing — A reliable, high-level breakdown.

Starting small is a great way to ease into the game without feeling like you’re risking too much. Many platforms, like Wealthsimple or Fidelity, allow you to begin with very modest amounts. Sometimes as little as $50 or $100. And with so many low-cost or commission-free trading options these days, your entry into investing doesn’t need to come with high fees.

So, getting started with investing is not hard at all. Nice. But, what is the hard part of investing? Let’s look at that.

The hardest part of investing

The hardest part of investing is staying invested when everything feels like it’s falling apart. The reality of investing can be nerve-wracking. There will be days, maybe even months or years, where the market seems determined to make you question every financial decision you’ve ever made.

When your portfolio takes a dive, and you watch your hard-earned money vanish before your eyes, that’s painful. You will feel actual pain in your stomach. And you will feel the urge to cash out, cut your losses, and run for the hills.

That’s when you know what the hardest part of investing is all about. It’s your mindset. Do you really believe that you want to be invested? Do you really know why you have invested your money? When times are tough, you need to go back to your Why and your Plan. You have written them down, right?! Read these again and convince yourself that what you’re doing is the right thing. Stay the course, knowing that bad times always end.

The importance of staying the course

It’s easy to stay invested when the market is soaring. Everyone’s a genius in a bull market. But true success in investing isn’t measured by how well you do when things are going great. It’s about how you react when everything seems to be going wrong. The tough days, when your portfolio is bleeding red, are when you make or break your future financial success.

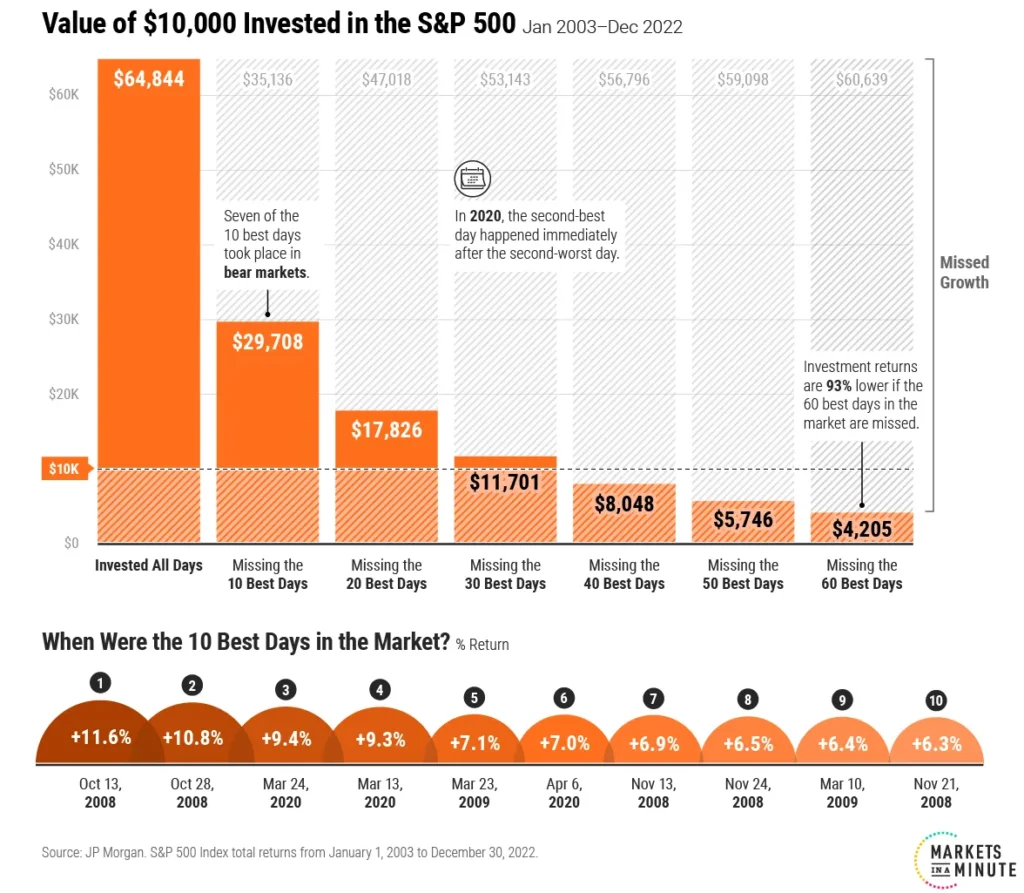

Why? Because history shows that the best days in the market often come right after the worst ones. Missing just a few of those best days can drastically reduce your returns. According to studies, if you miss just the 10 best days in the market, your long-term gains can be cut in half. Unfortunately, those best days are impossible to predict. They often happen during periods of extreme volatility and uncertainty.

returns more than 50% lower when missing the 10 best days

How to stay the course when the market gets rough

When the market dips and your portfolio’s in the red, it’s easy to panic. However, as mentioned before, staying the course is the hardest and most important part of investing. These five essential qualities will help you stay grounded in those tough times: a clear goal, motivation, discipline, determination, and patience.

1. Have a clear goal that sparks your imagination

What are you investing for? Is it to retire early and travel the world? To buy your dream home, or secure a better future for your family? Having a goal that truly excites you gives you a reason to stay invested, even when the market gets rocky. You need something that sparks your imagination, something you really want to achieve. This goal becomes your guiding light, pulling you through the tough times. And please, write it down and read it every now and then.

2. Stay motivated by remembering your why

Motivation is key to success in investing. When your portfolio takes a dive, it’s easy to get discouraged. In those moments, you need to remember why you started investing in the first place. Staying connected to your Why keeps you anchored and helps you push past the fear of temporary losses.

3. Discipline: just keep going

Discipline is a key factor of investing success. No matter how tempting it is to sell when the market is down, you need to stick to your plan. Consistently contributing to your investments, even in small amounts, and avoiding emotional decisions is crucial. Stick with your strategy, especially when it feels difficult. The mantra here is simple: just keep going.

4. Determination: you really want to achieve this goal

Your determination is what will carry you through the market’s darkest days. Because you’re not just investing for the sake of it, you’re investing because you want something important. Remember your goal?! Your determination to achieve that goal fuels your persistence. When the market tests your patience, it’s your determination that says, “I’m in this for the long haul, because this matters to me.”

5. Patience: the long game wins

Finally, patience is so important in this investment game. Success in investing takes time, a lot of time! Markets go up and down, but over the long term, they’ve historically trended upward. Patience means understanding that wealth-building is a marathon. By staying invested, you give your money the time it needs to grow and compound. Trust the process, and let time work its magic.

How to mentally stay the course

I get it, knowing all this doesn’t always make it easier. Watching your portfolio take a hit isn’t fun. Here are a few more tips to help you stay the course when your instincts tell you to run:

- Turn off the noise: It is understandable that the news can sometimes cause anxiety during times of market volatility. It seems that every pundit has a different prediction about what the future holds. However, it is important to remember that the market is driven by cycles, and that ups and downs are to be expected. Don’t let the daily noise influence your long-term strategy.

- Revisit history: Look at the history of the stock market. It has withstood world wars, financial crises, political upheavals, and more. Still, it has consistently grown over time. When in doubt, take a historical view.

- Stay diversified: A diversified portfolio helps reduce risk. If one sector or asset class is underperforming, others may be holding strong. Diversification cushions the blow of downturns and allows you to stay invested with more confidence.

- Talk to a pro: If you feel overwhelmed by your emotions, you might find it helpful to speak with a financial advisor. They can offer guidance and support in maintaining a sense of calm during challenging times.

Rough markets shape the mindset of successful investors

Every investor, no matter how seasoned, faces moments of doubt. But, the market’s volatility is just part of the journey. Over the long run, the stock market has always rewarded those who stayed the course.

Investing is about more than just growing your money. It’s also about growing your mindset! The best investors are the ones who learn to embrace the tough days. They know that every dip is just a chapter in a much bigger, much more profitable story.

Keep going! Time is on your side, and that’s when the real payoff comes. Time in the market is one of the most important things to achieve your goal. And when that happens, I always think of the famous words of Hannibal:

“I love it when a plan comes together!”

Leave a Reply